After improving my currency exchange situation I moved on to tweaking how I do banking and investing. I’ve held my assets at and done my banking with Royal Bank of Canada for many years. They’ve treated me well, extended me credit when I needed it, and I’ve learnt how to work within their online banking system. They are also the only bank within Canada that has a branch within the US. This branch is used exclusively for clearing transactions and allows me to receive direct deposit payments from US companies. A direct deposit done on a Wednesday appears on Thursday or Friday. It works great. This means I can never truly get away from Royal Bank of Canada completely but I can make my life a bit easier.

Go Go Online Bank

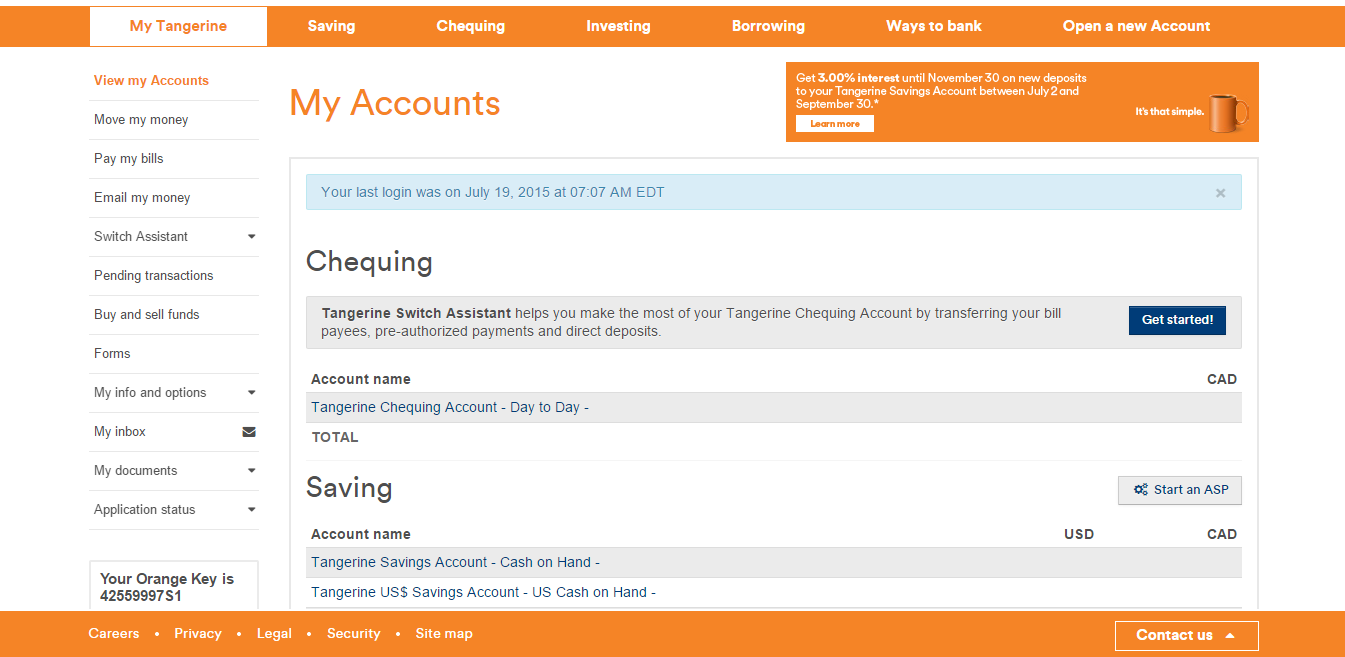

Prompted by a referral from a friend I signed up with Tangerine. They are a semi-online only bank which is owned by Scotiabank. I say semi-online because they have a few physical locations. The signup process was easy and didn’t require me to send in any paperwork. I took a picture of a cheque, it cleared, my account was open.

The signup process is also even easier if you have an existing account and want to add additional savings accounts. It takes less than a minute to have a new savings account open and available. In comparison to RBC which requires a few pages of online forms and waiting overnight.

Account Types

They’ve got your normal chequing account, savings account (in CAD and USD), TFSA savings, RRSP savings, and mutual funds. They can also do mortgages and secured line of credits.

Where they don’t yet have any products is in the unsecured credit area. They don’t yet offer a credit card (although it’s coming) and don’t offer an unsecured line of credit. If these are things you need then you need to go elsewhere for them.

Online Banking

Once this was done I quickly came to the conclusion that the Tangerine online banking is much simpler than Royal Bank of Canada and is more intuitive. Using it does not require me thinking “now if I had to shove this thing in here… I’d put it… here”. What I need is easily found and they continue to add more things to reduce the amount you need to talk to them. A recent addition is the ability to request that your Interac card limits be raised.

Customer Service

I haven’t really had to reach out to their customer service. I’ve tweeted them a few times with questions and they have responded promptly. I will say they refer to their customer service as award winning and from what I’ve read online I would agree.

As A Companion

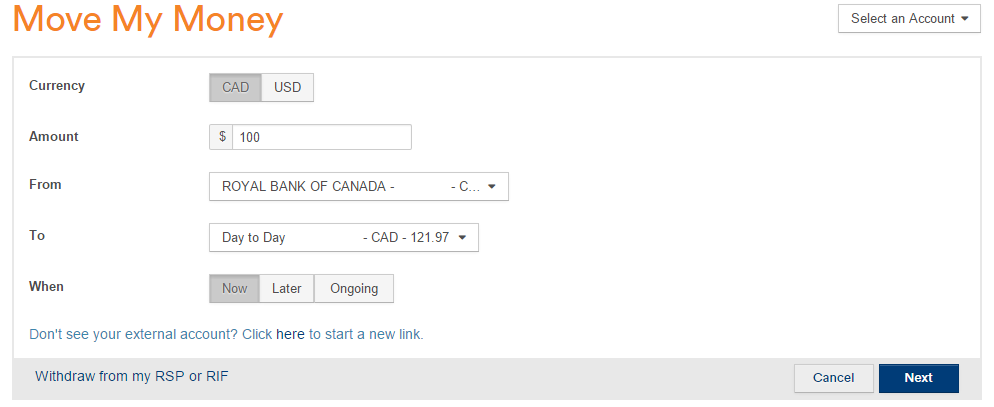

The nice thing about Tangerine is that you can add other bank accounts and transfer money to/from. This makes them a nice companion to other bank accounts in case you can’t completely get rid of them (like me). You can manually perform transfers or have it automatically done on schedule. I use this feature to move money to my Royal Bank of Canada account for payments that come out of it (such as mortgage).

When performing transfers between Tangerine accounts it is done instantly. When transferring money out to another bank account I’ve found it takes a day or two. When transferring money in from another bank account it takes a week. This is due to the fact that Tangerine holds the funds for a week for verification, so you can’t pull them back.

Alerts

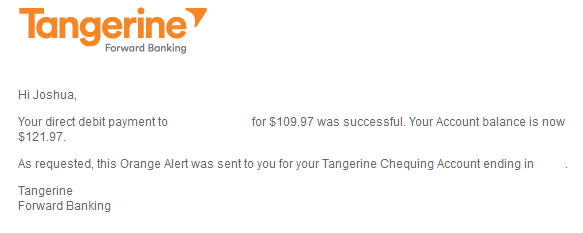

Tangerine has the best alerts feature in Canada. You can turn on alerts and set thresholds for when they occur. For me I have it so I get an email when deposits, bill payments, and large transfers happen.

Transaction information is also immediately available for everything unlike Royal Bank of Canada which shows some things as a generic description until the next day.

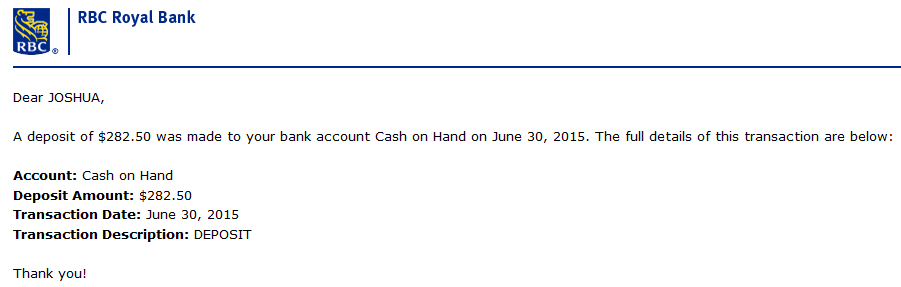

That deposit is actually a transfer from Tangerine into my Royal Bank of Canada account. Amusingly the next day it will show as an “INVESTMENT” from Tangerine.

ATMs

Since Tangerine is owned by Scotiabank you can use your debit card at Scotiabank ATMs and the few Tangerine branded ATMs that are in some large cities without any fees.

But wait… they also have access to the Scotiabank Global ATM Alliance. This is something I don’t think a lot of people know about. This is an alliance of banks that charges no fees to each other when a customer of a bank in the alliance uses their ATMs. What does this mean? You can go to Bank of America in the US and withdraw USD, paying only the exchange rate. This also goes for Barclay’s in the UK and banks in other countries. A full list is here.

Interest

They always have a better interest rate than the other banks. So much so that I have actually gotten a nice amount just from the money I keep on hand. Sometimes during the year they also have either general or targeted promotions. Right now new deposits to my savings accounts are actually accruing interest at 3% instead of the current normal 1.05%.

Below is a handy table which shows the current interest rates of banks, these interest rates assume a lowish balance. I’ve provided the direct links for each bank so you can determine what the best account would be for your balance.

| Bank | Savings | Chequing |

| Tangerine1 | 1.05% | 0.25% |

| President’s Choice[^n] | 1.05% | 0.05% |

| RBC[^n] | 0.80% | 0.00% |

| CIBC[^n] | 0.05% | 0.00% |

| Scotiabank[^n] | 0.10% | 0.00% |

| TD[^n] | 0.05% | 0.00% |

| BMO[^n] | 0.75% | 0.00% |

All interest rates are as of July 19th, 2015

Fees

What fees? Seriously. The fees only exist for the exotic things you rarely need: Interac e-Transfers, cheques, bank drafts, off-network ABM withdrawals, and NSF. I have yet to need any of these and have incurred no fees. They have so few fees even that they all fit on a single page. You can find it here.

Signing Up

Personally I see no reason not to sign up with Tangerine and give them a try. I haven’t run into any problems and have had a great experience. Signing up is also pretty easy. Visit the Tangerine website at https://www.tangerine.ca/ click “Open a New Account” and follow the instructions. If you’d like to earn $50 for signing up (with a $100 deposit) use my Orange Key 42559997S1 and we’ll both enjoy the nice bonus. Do you have to though? Nope! Up to you.